Vacasa

North America’s largest tech-enabled vacation home rental management platform.

Quick Facts

Background

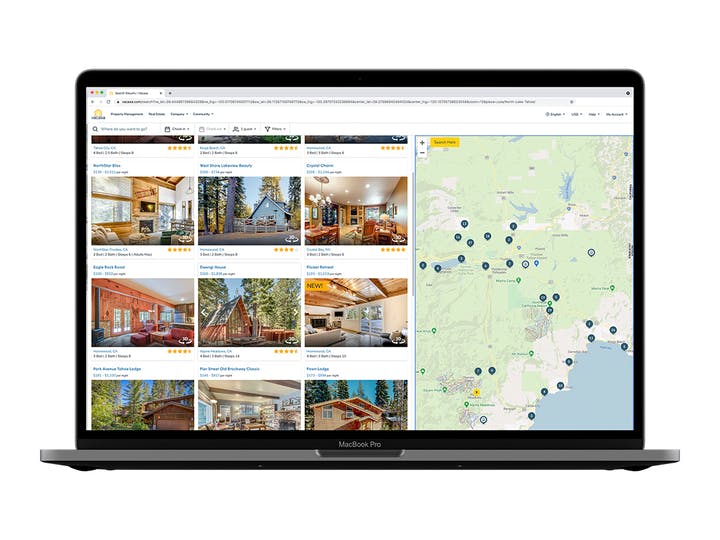

Vacasa is the leading vacation rental management platform in North America. The company’s integrated technology and operations platform optimizes vacation rental income and home care for homeowners, offers guests a seamless, reliable, and high-quality experience with exceptional service, and provides distribution partners with valuable and high-performing inventory. Vacasa’s global marketplace aggregates approximately 35,000 exclusive listings and enables guests to search, discover, and book properties on Vacasa.com, a guest app, and on the booking sites of over 100 distribution partners.

Opportunities

Early Innings of Unlocking the Massive But Highly Fragmented Vacation Rental Market

Vacasa’s 35,000+ units under management represents less than 1% market penetration of 25 million properties worldwide. Vacasa raised our capital to take advantage of this massive $200B+ annual revenue opportunity.

Build Management Team to Support A Rapidly Growing and Complex Business

In order to support Vacasa’s increasingly complex business at scale, Vacasa needed to hire a full senior management team with experience running scaled, publicly-traded companies.

Capitalize on Highly Accretive M&A

Since inception, Vacasa has grown through a combination of organic unit acquisition and acquiring smaller, offline property managers. Our capital enabled Vacasa to accelerate this highly accretive M&A activity.

Value Created

Vacasa worked with Level to sustain rapid revenue growth at scale, resulting in over 22x bookings growth for the six years prior to its IPO. Level worked with Vacasa’s founder to significantly expand the senior management team through many key hires including the CEO, CFO, COO, CTO, CRO, Chief Product Officer, and Chief Legal Officer. We helped build out the Board of Directors by recruiting the former CEO of HomeAdvisor, CFO of Adaptive Biotechnologies, and CMO at Roblox.

Level helped to orchestrate meaningful acquisitions including the assets of Wyndham Vacation Rentals and Turnkey Vacation Rentals. In July 2021, Vacasa announced an agreement to become a publicly traded company through a business combination with TPG Pace Solutions, a special purpose acquisition company (SPAC). The Company completed an IPO on the NASDAQ in December 2021, valuing the company at $4.4 billion.

Partner Testimonial

“When things get tough, you really understand what kind of partner you have. I’m so appreciative of the way Level has supported us. They’ve given us advice and shared experiences with members of other portfolio companies to help us drive success.”